Breakouts Setup Qullamaggie Style |

您所在的位置:网站首页 › sideway move › Breakouts Setup Qullamaggie Style |

Breakouts Setup Qullamaggie Style

|

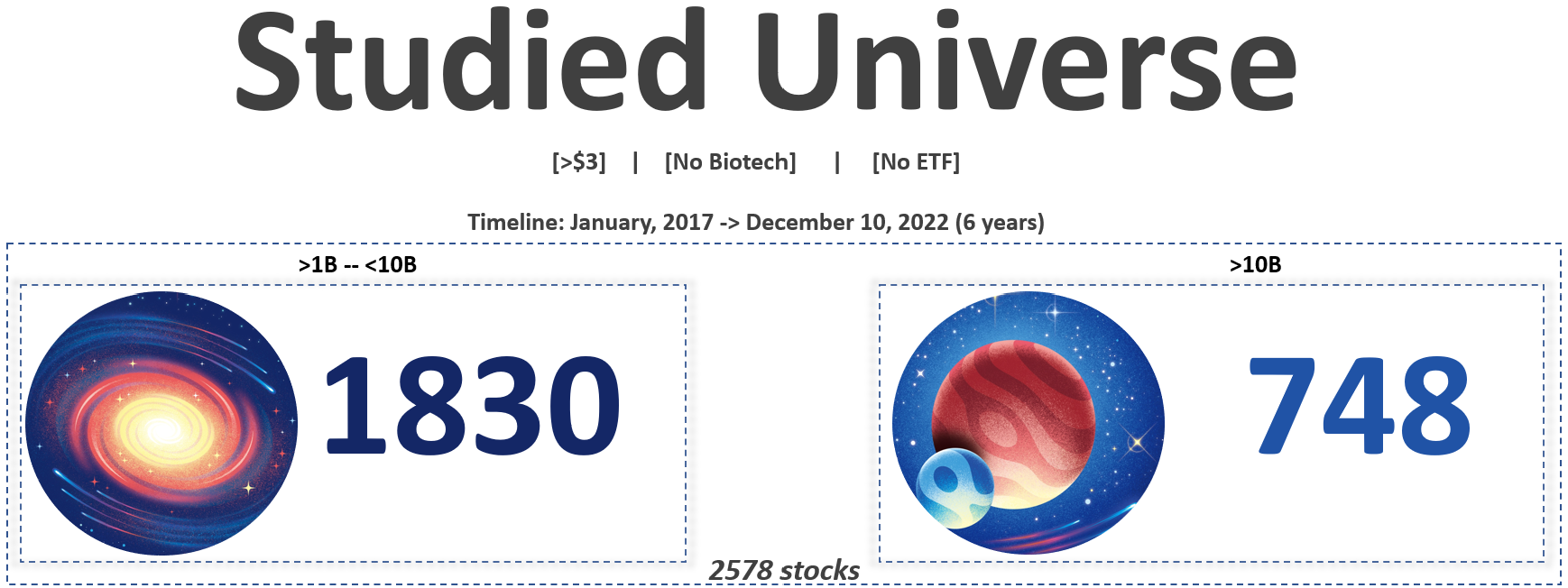

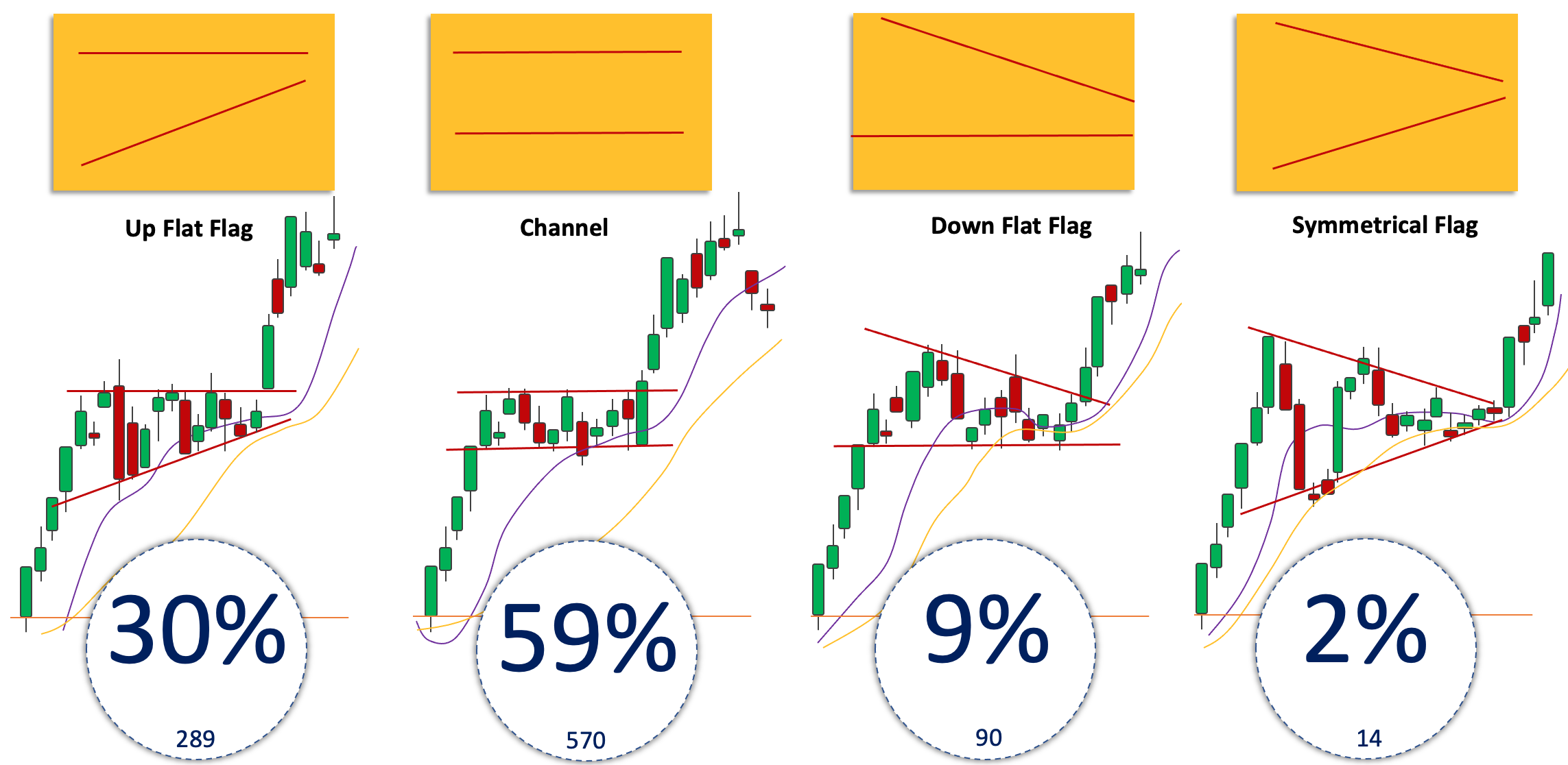

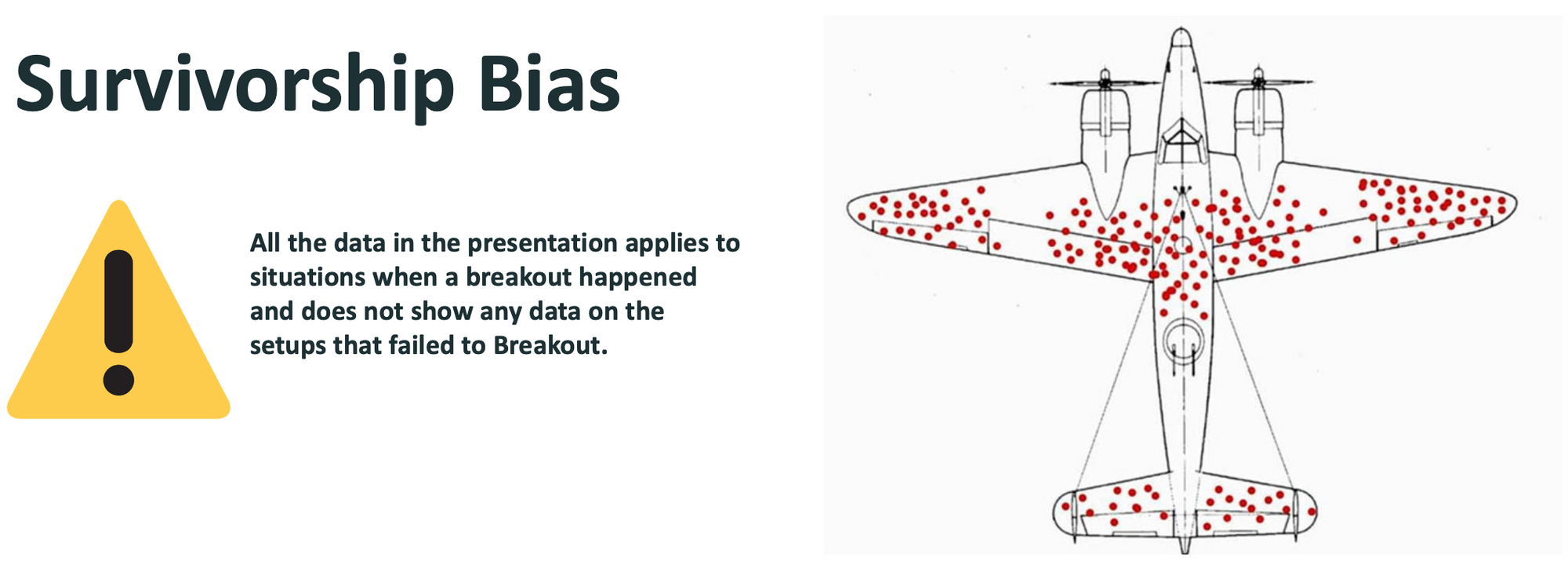

Pro Level Setup! Kristjan Qullamaggie shares a lot of information about this setup on his blog (https://qullamaggie.com/) and in his YouTube channel (@Qullamaggie). To better understand the setup, I did a Deep dive on the last 6 years of data available in TC20000 to a total of 2578 stocks. My main goal was to identify the setup, review its pattern and measure its key parameters in order to get an edge in my trading strategy. Here are more details on the studied universe and the number of breakouts that were identified.   In the video below are presented key facts that I learned while doing the deep dive. I highly advise you to watch it. Its just packed with good quality information. 馃専Download the Presentation + Breakouts Classified based on Patterns + All sectors and SPY Breakouts Map+ the Excel File with all measurements per breakout on the link belowBreakout Setup Qullamaggie Style Deep Dive ResultsBreakouts Setup Deep Dive Contains: the slides presented on YouTubethe full list of 963 Breakouts Classified based on their PatternBreakouts Map for All Sectors and SPYAn Excel file with all measurements that were performed for statistical analys... The Breakouts form a distinctive Pattern, highlited by Kristjan Qullamaggie in one of his videos. I tried to identify those Patterns during the deep dive and classify the full list of 963 breakouts accordingly. Here is the % per Pattern:  For the full list of Breakouts I measured some key parameters of in order to create a statistical picture of how this setup is behaving. The second part of the YouTube video shared above goes in details on each measurement. 馃挕Here is how I would describe the setup based on the collected data:The first leg of the breakout is an important sign of momentum and a key criteria to identify the setup. The leg should have +12% or higher.First leg forms in most of the cases in 3 to 7 days. Then, the stock pullsback and goes sideway into a consolidation phase of 7 to 12 days. Within sideway move in 89% of cases it will make a "channel" or "Up flat flag with higher lows" pattern. If the momentum is present the stock will breakout, making in 76% of the cases at least 16% up. If moving the Stop Loss below the 10 days moving average in 60% of the breakouts you get stopped with less than 16% profit.See more details in the video.  Following the Deep dive I was curious to see in what market environment most of the Breakouts happened. As a result, I mapped them all on the SPY chart to see what the data will suggest. The findings are presented in the video below: Have in mind that all the data shared during the deep dive refers to the patterns that had a first leg then a sideway move then actually did a breakout move forward. It does not refer to the breakouts that failed. The study has a survivorship bias (selection bias).  馃挕If you found the information useful please download the e-book listed above or share the study in your Discord or Reddit community. Good luck! 馃挕If you found the information useful please download the e-book listed above or share the study in your Discord or Reddit community. Good luck!

|

【本文地址】